CFC #005 - Stress Less with Financial GPS

Jun 03, 2023

Stressing to get where you want to be financially in your services business?

You’re not alone:

Over two-thirds (66%) of small businesses significantly struggle financially.

One reason for this is a lack of financial clarity.

Last week I shared my 4W1H Method for setting the right financial goals for your business. If you missed it, you can check it out here.

Setting the right goals is a key step in getting the clarity you need to achieve your desired results.

However, it’s part of a larger process, which I call Financial GPS.

Today, I want to give you a glimpse of that process.

But first, let’s explore some context on why you may be struggling.

Why business owners fail financially

Many founders who struggle to get the financial results they want are flying blind.

They:

- Don’t fully know where their business stands today, financially

- Don’t know what metrics to look at, or what they mean

- Don’t have clarity on where they need to take their business to achieve what they want

- Don’t have clarity on what they want or why they want it

- Don’t have a consistent monthly process to find out what happened financially in their business and why it happened

- Don’t know how to use their financial information to get from where they are to where they want to go

- Don’t have a clear sense of when they want to achieve their goals and when they’ll take action to make that happen

Trying to operate your business without solving the above issues is like trying to put together a clear jigsaw puzzle that doesn’t have a picture - incredibly frustrating and potentially futile.

And the longer you try to grind it out in this situation, the more it can cost you in lost money, lost opportunity, lost time, lost effort, and lost quality of life.

There’s nothing worse than looking back with regret at the life you could have lived if you hadn’t been too stubborn to change your approach and get help sooner.

(Btw, my aunt-in-law brought one of these clear puzzle abominations to our house one weekend. Unless you’re a glutton for punishment, I don’t recommend them.)

Fix your frustrations with Financial GPS

So how do you overcome these obstacles to produce the results you desire?

The solution is to implement financial GPS in your business.

Financial GPS has 3 steps:

The first step is setting good goals. We discussed this with the 4W1H Method.

The next step is implementing strong financial reporting.

And the final step developing and using a budget/forecast.

I’ll share more specifics on these steps in future editions of this newsletter.

Today, I want to give you a simple visual to help you understand what Financial GPS looks like and why you need it.

A picture for financial success

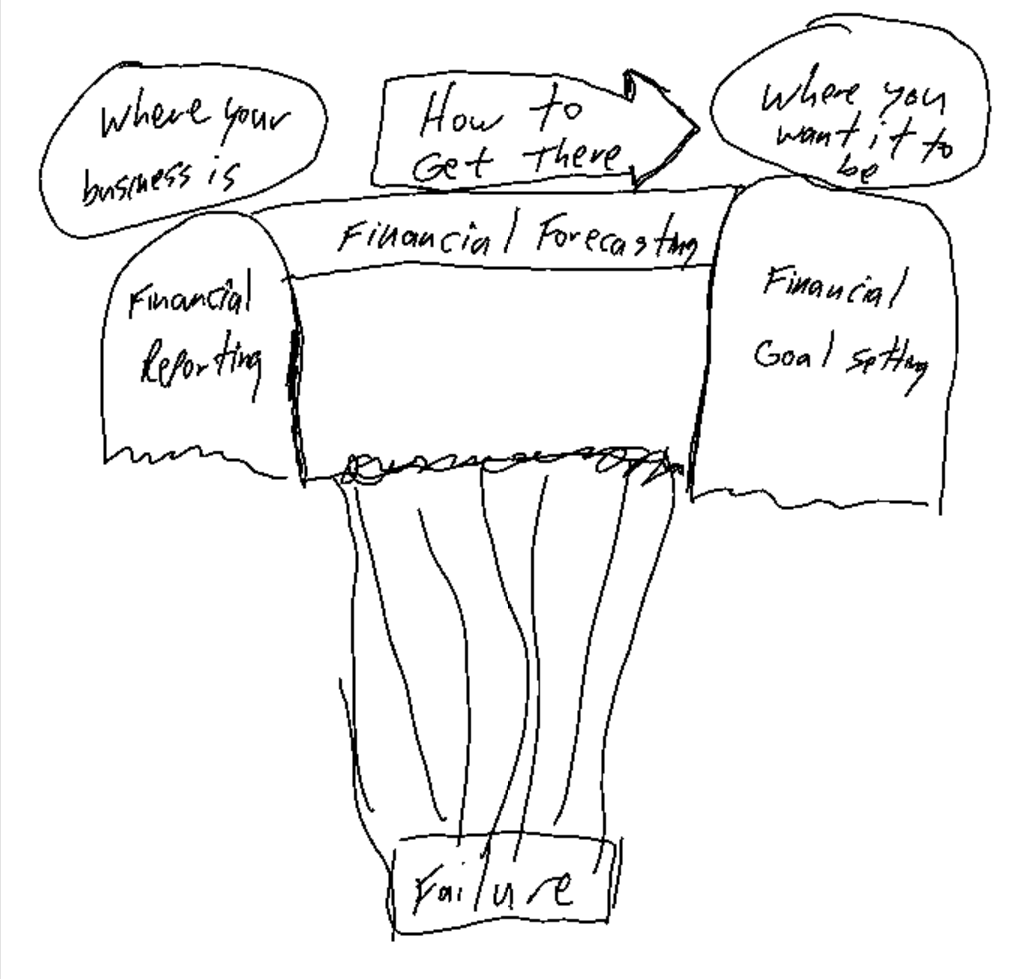

Imagine a chasm with a river rushing below it.

This river leads to a waterfall that dead-ends on the rough rocks of failure.

Your business is on one side of this chasm.

You want it to be on the other.

Fortunately, you can build a bridge to help you safely and swiftly cross the river to your desired destination.

Financial reporting gives you crucial information on where your business currently is.

Financial goal setting gives you clear coordinates for where you want to go.

And financial forecasting is the bridge that helps you think through the actions you’ll need to take to get from where you are to where you want to be, without dashing your hopes on the wet (tear-stained?) rocks of failure.

Below is a rough sketch of what this looks like.

Here’s an example of financial GPS in action.

Recent Case Study

One of my service business clients, a lead generation agency, wants to grow from $1M in revenue to $3M.

However, they were struggling with cash flow, despite both founders working over 60 hours per week.

One of the first things we did after they hired my firm, Flight Financial, was to help them implement financial GPS.

- We fixed their financial reporting - as a result, we found over $35k in uncollected client invoices (most of which my client was then able to collect). We also identified ways to improve their profitability and cash flow in the next 3 months.

- We helped them set clear financial goals with the 4W1H Method - this focused their efforts on what matters and lowered their feelings of stress and overwhelm.

- We helped them implement a financial forecast - this revealed what would need to change in their business. It gave them a clear action plan to help them achieve their goals.

As an added benefit, they now have big picture context to keep them from getting too discouraged during hard times.

For example, they had a bad month in March. They missed their sales goal by about 75%.

But one bad month doesn’t make a bad year. April rebounded and May was one of their best months yet.

Having financial GPS installed helps them keep their financial performance in perspective. It can help you too.

What’s next?

Financial GPS is like LASIK for your business’s financial performance. Once you have it, you’ll finally be able to see your business’s financial picture clearly.

Both what’s up close (your recent performance).

And what lies ahead (your next steps per your forecast that will lead you to the sunny horizon of your goals).

And as you may want to know what LASIK entails before you’d submit to the procedure, you may want to know more about financial GPS before you implement it in your business.

So, next week, I’ll share more delicious details on financial reporting so good, you won’t care about the calories.

Stay tuned!

In the meantime, if you’re looking for more, there’s a couple ways I can help you:

- Watch my free on-demand training on my 5-step system you can use to get the financial results you want from your business and feel less overwhelmed. Free training here.

- I can help free you from financial stress in your $1M+ services business and discover a faster route to the results you need for the life you want. Book a call here.